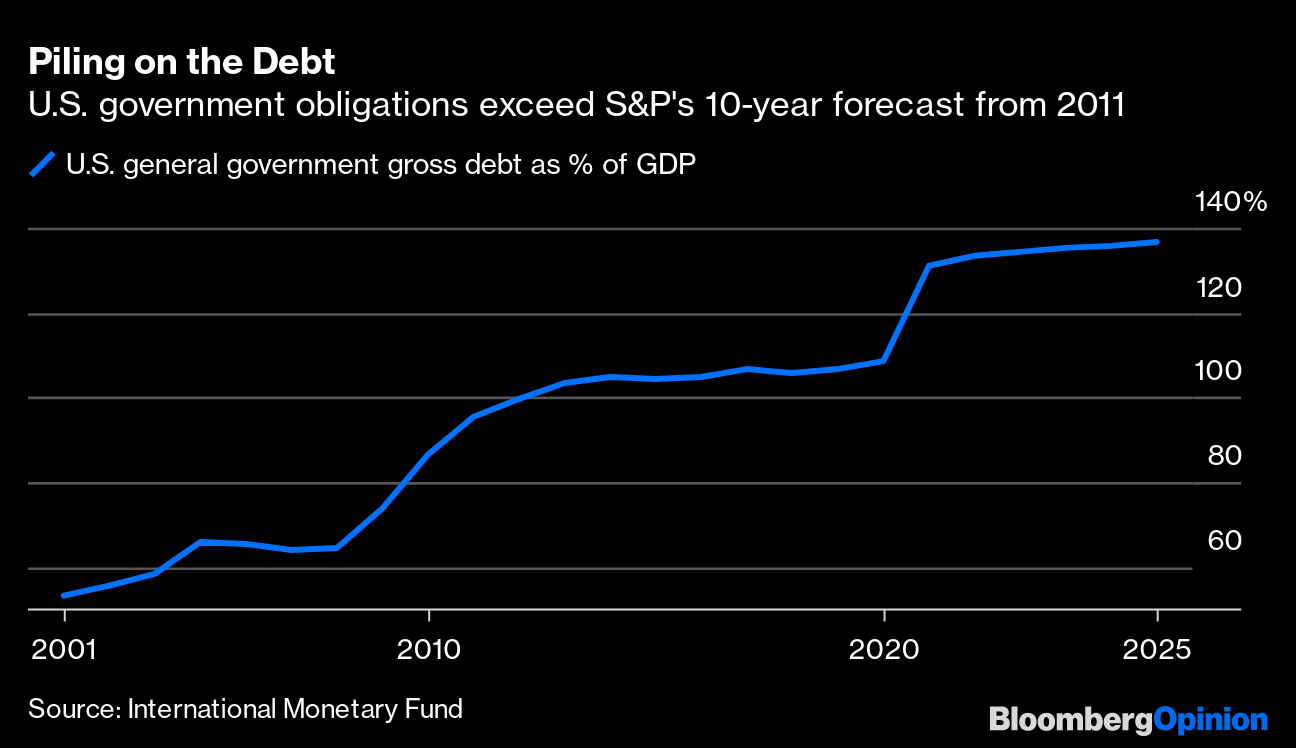

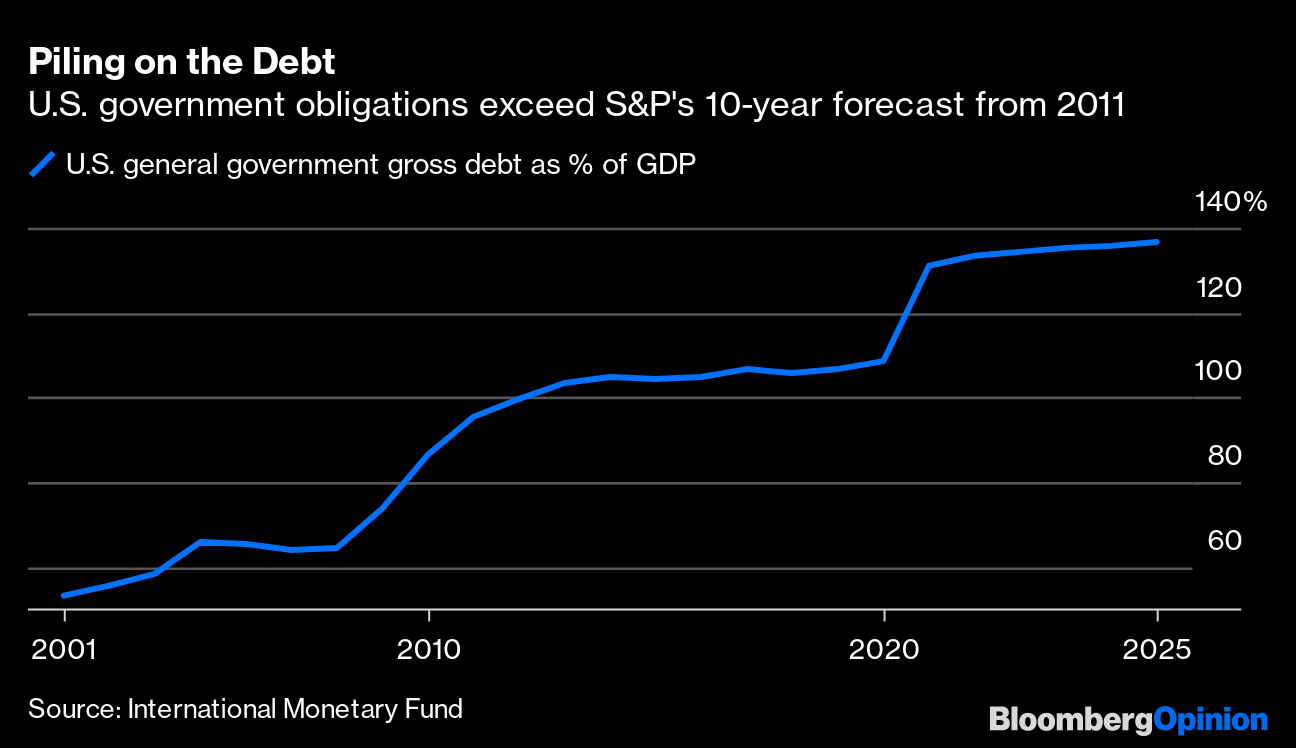

This is Bloomberg Opinion Today, a credit report of Bloomberg Opinion’s opinions. Sign up here. Today’s AgendaAmerica’s Downgrade Non-Crisis Turns 10Where were you on August 5, 2011? No idea? Here’s a hint: It was a day something historic and unthinkable happened. Those usually burn into your memory, right? Like the JFK assassination or the 9/11 attacks. But you could be forgiven for having no recollection of August 5, 2011, which was the day Standard & Poor’s downgraded its credit rating for the United States of America. It was indeed historic and shocking. But it was almost immediately forgettable, because it was so meaningless. Other rating agencies ignored it, and America has had no trouble getting loans in the decade since. Nevertheless, John Chambers, the former S&P analyst responsible for the downgrade, recently told Brian Chappatta that he has no regrets. The political dysfunction that inspired the downgrade (remember the ridiculous debt-ceiling fight?) has only gotten worse, he says. Even the $2 trillion mistake by the rating agency in forecasting the country’s future debt burden has been rendered moot by the wild spending and tax-cutting we’ve seen in recent years. S&P has had plenty of chances to upgrade the U.S. from AA+ but has repeatedly declined, as recently as this week.  Of course, credit ratings only have meaning if society agrees they have meaning, like money or Libor or Christopher Nolan films. The financial crisis taught us hard lessons about giving ratings too much power. And again, the U.S. still has no trouble borrowing, despite all the dysfunction and spending and whatnot. But Democrats must think Chambers is at least partly onto something, given they plan to raise taxes to help pay for their next big spending package. Read the whole thing. Further Political-Dysfunction Reading: A " talking filibuster" won't solve the Senate’s filibuster problem because the GOP is perfectly willing to spend as much time as it takes reading Green Eggs and Ham or whatever. — Jonathan Bernstein The Next Elon Musk Spricht DeutschVolkswagen today became Germany’s most valuable company, which is a little like becoming the best baseball player in AAA. Its $166 billion market cap would put it maybe in the top 50 of U.S. public companies, and mathematics informs us that’s just a fraction of Tesla’s $650 billion. Still, you’ve gotta start somewhere, and VW is on the rise because it's looking more and more like a true rival to Tesla, writes Chris Bryant. They also have a longer track record of producing vehicles. Now it’s focusing on software and batteries with a view toward electrifying half its new cars by 2030. On the downside, VW also has an old-line automaker’s high costs, including gazillions of employees. But VW might also have an easier time scaling up than Tesla has, making Herbert Diess a real threat to take Elon Musk’s Technoking crown. Building a Biden DoctrineIt’s early days yet, but President Joe Biden isn’t exactly reviving every aspect of his old boss’s foreign policy. That may be a good thing. For example, Eli Lake notes, Secretary of State Antony Blinken, ahead of a meeting with Chinese officials in Alaska tomorrow, has used some surprisingly tough language about Beijing’s aggression and treatment of Uyghurs. This might help reassure regional allies that Biden won’t be as forgiving as Barack Obama or as unfocused as Donald Trump about China’s threat. Less encouraging, so far at least, has been Biden’s attitude toward Syria, writes Bobby Ghosh. Obama infamously drew a “red line” there and let Bashar al-Assad cross it. Trump didn’t make such a glaring mistake but was still too passive. Biden’s actions so far promise more of the same. Syria is too important for such neglect, Bobby writes, requiring more aggression — including, God forbid, the enforcement of red lines. Bonus Foreign-Policy Reading: Boris Johnson’s “Global Britain” vision is ambitious, but expensive. — Therese Raphael Telltale ChartsAs Jay Powell suggested today, dismissing market agita about the threat of higher prices, inflation isn’t even close to becoming a problem. Nir Kaissar points out the nightmarish stagflation of the 1970s built up very slowly and with plenty of warning. Policy makers won’t let that happen again.  Further ReadingThe CDC’s six-foot-distance rule keeps kids out of schools despite studies showing a three-foot distance is just as safe. — Bloomberg’s editorial board Facebook must confront its vaccine-skeptic problem. — Tim O’Brien Fighting the Purdue bankruptcy deal because it strips too little from the Sacklers risks keeping money from victims. — Joe Nocera A new study shows Keynes was right about real estate being riskier than it seems. — John Authers We’ve been mistakenly blaming margin debt for market crashes since the ‘20s. — Stephen Mihm Racial bias in NFL concussion tests deprives Black players of settlement money. — Cathy O’Neil The NFT craze is no different from other parts of the art market. — Tyler Cowen ICYMIThe IRS is delaying the tax-filing deadline. Trump’s net worth has taken a hit. An ARKK copycat is trouncing Cathie Wood’s ETF. Kickers10,000-year-old basket found in Israel. (h/t Ellen Kominers) App creates fake noise to help you escape Zoom meetings. (h/t Mike Smedley) Dogs may be 95% accurate at sniffing out Covid. The human brain developed because larger animals went extinct. Notes: Please send fake noises and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |