- Amgen, Salesforce, Honeywell to join blue-chip index

- Oil giant among three ousted with Raytheon and Pfizer

The dominance of technology companies has eclipsed every other story in 2020’s pandemic-upended stock market. Now it’s helping speed changes to the world’s most famous equity benchmark.

In the biggest reshuffling in seven years, Exxon Mobil Corp, Pfizer Inc. and Raytheon Technologies Corp. were kicked out of the Dow Jones Industrial Average, making way for Salesforce.com, Amgen Inc. and Honeywell International to enter the 124-year old equity gauge a week from today. The actions were prompted when Apple Inc. -- currently 12% of the 30-stock index -- announced a stock split that reduced the sway of computer and software companies in the price-weighted average.

The changes mark a stunning fall from grace for Exxon, the world’s biggest company as recently as 2011, whose ejection reflects the steady decline of commodity companies in the American economy. They represent an equally significant embrace of technology firms, whose giant rallies have have caused the Dow to trail other indexes this year.

“Those changes are a sign of the times - out with energy and in with cloud,” said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance.

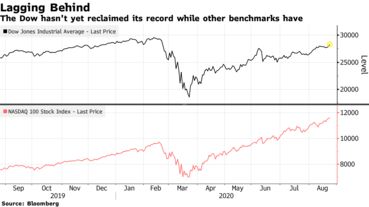

The latest reshuffling comes as technology companies have surged past every other industry in a trend amplified by this year’s Covid 19 lockdowns. While the Dow average is still 4.2% off its February record, the tech-heavy Nasdaq 100 is almost 20% above the pre-pandemic all-time high.

While any change to the Dow is notable, the ejection of Exxon Mobil, the longest-serving member, marks a particularly rapid shift in fortunes. Worth $525 billion in 2007 and more than $450 billion as recently 2014, the stock had fallen in four of six years before 2020 and is down another 40% since January. It’s now worth about $180 billion.

Founded in 1999, Salesforce was one of the best-performing stocks of the bull market following the global financial crisis, rising 27-fold since March 2009. Amgen is among the world’s biggest biotechnology companies with a market value of about $137 billion, though it’s replacing a company -- Pfizer Inc. -- that is about $90 billion larger.

Stocks of the affected companies were quick to price in the shake-up. Shares of Exxon dropped 2% as of 6:10 p.m. in New York, in after-hours trading, while Raytheon fell 3%. Honeywell climbed 3.5% and Salesforce.com rose 4%. Pfizer dropped 1.9% and Amgen rose 4%.

“This action does not affect our business nor the long-term fundamentals that support our strategy,” Exxon said in an email. “Our portfolio is the strongest it has been in more than two decades, and our focus remains on creating shareholder value by responsibly meeting the world’s energy needs.”

This is the second time a stock split by Apple has had big consequences for the Dow. The first was in 2014, when its 7-for-1 split lowered the price of its shares enough to make inclusion feasible. Apple’s decision to do it again this year effectively lowered its sway on the price-weighted average, making the influence of technology companies too small in the eyes of the Dow’s handlers.

Under-representation in technology has penalized the Dow in 2020, when it has frequently trailed the market-cap weighted S&P 500, whose concentration on megacap companies like Amazon.com and Alphabet has juiced its returns. Neither of those companies are effectively eligible for the Dow given their $1,000-plus share prices.

The blue-chip index weights its constituents by price rather than market value, making it different from the broader S&P 500. A committee chooses members in an effort to maintain “adequate” sector representation and favors a company that “has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors,” according to its website. Other major indexes add and subtract members on a rules-based process.

Honeywell, meanwhile, is returning to the average after being kicked out 12 years ago to make way for a financial services company, Bank of America, and an energy producer, Chevron. Its shares are down about 9% in 2020 but before that had risen in 10 of 11 years, pushing its market value above $100 billion.

The New Dow Jones Industrial Average

Ranking of new member companies by share price

Source: Bloomberg

*Note: Divides Apple Inc. share price by four for upcoming stock split; Prices as of 8/24/2020

While the Dow’s influence has faded over the years as passive managers linked to benchmarks based on market value, the index remains an exclusive club and still serves as one of the highest profile showcase of American industrial heft. Roughly $31.5 billion of assets are benchmarked to the Dow, with $28.2 billion of passively managed funds linked. (The figures are $11.2 trillion and $4.6 trillion for the S&P 500.)

The last time three companies were added to the Dow was seven years ago, when Visa Inc., Goldman Sachs Group Inc. and Nike Inc. displaced Bank of America Corp., Hewlett-Packard Co. and Alcoa Inc.

— With assistance by Kevin Crowley